tax effective strategies for high income earners

Creating retirement accounts is one of the great tax reduction strategies for high income earners. In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege.

What Are The Most Effective Business Management Strategies Marketing Insights Risk Management Sales And Marketing

If you are a high earner with an income above the IRSs income limit for Roth IRA accounts you still have the option to create a backdoor Roth IRA.

. These penalties can range from fines to imprisonment for more. If theres potential for a high return by investing a smaller amount of money upfront Roth can be the way to go. Taking advantage of all of your allowable tax deductions and credits.

Even worse high income earners are working Monday Tuesday and some of Wednesday just to pay the tax man. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. But its one of the simplest tax strategies to employ if youre not currently maxing out on it.

Additionally you are not required to pay taxes on investment earnings from retirement accounts until you actually withdraw them. Contact a Fidelity Advisor. Regardless of whether you are an.

Strategy 2 Defer Taxes on Realized Gains If youre looking for another way to avoid paying higher taxes now then it might make sense to defer taxes on realized gains. With a CRT high-income earners and small business owners can give to a worthy cause while creating an income stream for themselves or their loved ones. If you are a high earner with an income above the IRSs income limit for Roth IRA accounts you still have the option to create a backdoor Roth IRA.

Not only had this concentrated stock position exposes the. Every high-income earner should have a plan to diversify the taxation of income in retirement. Tax Planning Strategies for High-income Earners 1.

Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the Australian Tax Office ATO. Scottish taxpayers will continue to be subject to income tax at 5 different rates ranging from 19 Starter Rate to 46 Top Rate for any income in excess of 150000. When you invest in an RRSP the amount of your contribution is deducted from your taxable income thereby reducing your tax bill.

If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available. At Buttonwood this process starts by duplicating 2020 tax return data and updating the data for 2021. Just as it sounds this option allows high earners to bypass the income limits and still utilize the tax advantages of a Roth IRA account.

If you are a high-income earner it is sensible to implement tax minimisation strategies. How to Reduce Taxable Income. For taxable accounts a tax-efficient index mutual fund andor ETF may help reduce.

Either way it is beneficial to take advantage of the tax-reducing benefits of these accounts by contributing maximum income to reduce the tax burden. Take advantage of vehicles for future tax-free income. You are allowed to put in 3600 per individual per year and 7200 for families in 2021 and 3650 and 7300 for families in 2022.

The bigger part extends that low rate all the way up to 200000 abolishing an entire rung of the tax ladder paid by the highest earners. The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for high income earners who want a future tax-free income. High-income earners like senior executives who accumulate a large concentrated stock from their employer.

Trial Tax Return. To obtain updates run reports via a financial planning portal. For every dollar you earn youre giving up nearly half to the tax man.

The annual gift tax exclusion gives you a way to remove assets from your taxable estate. Income splitting and trusts. If theres potential for a high return by investing a smaller amount of money upfront Roth can be the way to go.

1 Managing through. A CRT is a gift of cash or other property to an irrevocable trust. The law permits you to deduct the amount you deposit into a tax-certified retirement account from your tax return.

6 Tax Strategies for High Net Worth Individuals. The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for high income earners who want a future tax-free income. To create a backdoor Roth IRA youll need to.

5 Reduce Taxable Income with a Side Business. Effective tax planning with a qualified accountanttax specialist can help you to do that. According to the ATO youre classified as a higher income earner if you earn over 180000 a year.

Qualified Charitable Distributions QCD 4. If youre a very high income earner this wont save you a ton on taxes. In most cases here youre trading a current tax benefit in the form of lower taxable income now for a future benefit of tax-free income laterDespite being in a high tax bracket currently you could be in an even HIGHER tax bracket in the futureeven if you have lower income.

In 2021 the employee pre-tax contribution limit for 401 k and 403 b plans is 19500. It works by setting up a prescribed rate loan. If you have a high-deductible insurance plan you can put some of your money in Health Savings Accounts for retirement and medical purposes.

Tax deductions are expenses that can be. This is one of the most important tax strategies for you as a. This is one of the most basic tax strategies for high income earnersthat you can take advantage of.

A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account. We recommend doing a trial tax return before year-end to assess your tax implications thus allowing for current year action to maximize tax opportunities.

One of the best strategies of reducing taxes for high income earners is by way of donor-advised funds because it has a potential of allowing you to take advantage of current and future year contributions and deduct them all in the current year. You may give up to 16000 32000 if you are married to as many individuals as you wish without paying federal gift tax so long as your total gifts keep you within the lifetime estate and gift tax exemption of 1206 million for 2022. Avoid concentrated stock positions.

To create a backdoor Roth IRA youll need to. Use a Health Savings Account HSA Photo by Online Marketing on Unsplash. A donor-advised fund DAF is an investment account created to support charitable organizations.

Just as it sounds this option allows high earners to bypass the income limits and still utilize the tax advantages of a Roth IRA account. If you are 50 or older you are eligible to contribute another 6500 as a catch-up contribution. With a DAF you can make a.

5 Reduce Taxable Income with a Side Business.

Tips For Charitable Giving During The Holidays Charitable Giving Charitable Giving

When An Llc Actually Needs An Accountant A Simple Checklist By Matt Jensen Taxes Taxeseason Taxesdone Taxesmiam Small Business Tax Business Tax Llc Taxes

Investing Mistakes To Avoid Digital Marketing Agency Marketing Strategy Digital Marketing

4 Benefits Of Being An Employee Vs An Independent Contractor Independent Contractor Contractors Make More Money

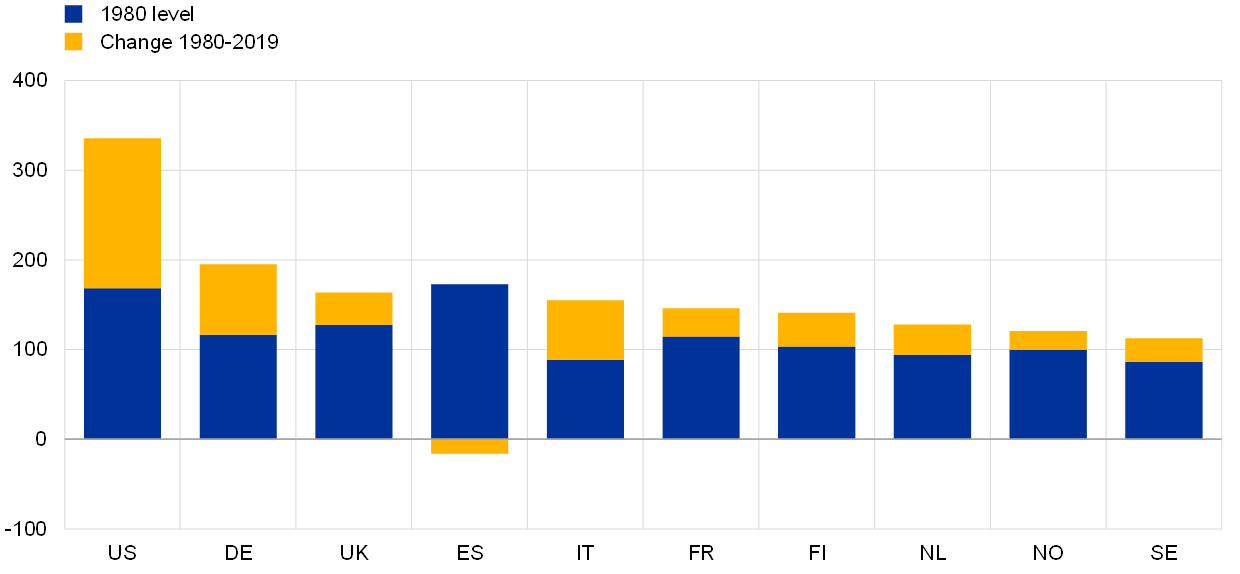

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Monetary Policy And Inequality

What Are Real Assets And How To Diversify Your Wealth By Investing In Them Investing Diversify Business Management

Why It Matters In Paying Taxes Doing Business World Bank Group

Tax Minimisation Strategies For High Income Earners

Pin On Best Of The Millennial Budget

What Is Wrong With The American Tax System For The Middle Class Finance Organization Finance Planner System

Asset Protection Made Easy How To Become Invincible To Lawsuits Save Thousands In Taxes And Set Up A Successful Esta Financial Peace Protection Kindle Books

Are Your Parents Too Old To Drive Vroomgirls Tax Services Capital Gain Tough Conversations

How To Set Up A Backdoor Roth Ira For High Income Earners Money Management Money Management Advice Money Saving Strategies

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

How We Budget A 2 200 Monthly Income In A Big City Budgeting Budgeting Worksheets Money Saving Tips

Creative Ways To Retire Early Consumer Credit Early Retirement Retirement Quotes Retirement